Content

For example, suppose a proposed sale of items does not occur because the expected client opted to go with another supplier. In a static budget situation, this would result in large variances in many accounts due to the static budget being set based on sales that included the potential large client. A flexible budget on https://kelleysbookkeeping.com/ the other hand would allow management to adjust their expectations in the budget for both changes in costs and revenue that would occur from the loss of the potential client. The changes made in the flexible budget would then be compared to what actually occurs to result in more realistic and representative variance.

The reporting of the energy per unit of output has sometimes been in error and can mislead management into making changes that may or may not help the company. A new business could vary a great deal from what was originally planned, and flexible budgets offer a real-time view of a business’s expenses and revenues. The savvy business owner may not have time to go through the trouble of issuing a forecast for the static budget. The flexible budget accomplishes the forecast in one step.

Definition of a Flexible Budget

If a budget is prepared assuming 100 customers will be served, how will the managers be evaluated if 300 customers are served? Similar scenarios exist with merchandising and manufacturing companies. To effectively evaluate the restaurant’s performance in controlling costs, management must use a budget prepared for the actual level of activity.

What is the connection between static budgets and flexible budgets?

Static vs Flexible Budgets

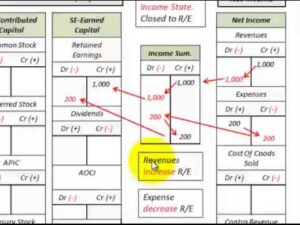

Static Budget – the budget is prepared for only one level of production volume. Also called a Master budget. Flexible Budget – a summarized budget that can easily be computed for several different production volume levels. Separates variable costs from fixed costs.

In our Simply Yoga example, we first just looked at the number of students through the door as a cost driver. But, then we also need to look at how many classes are taught and how that may affect wages and other costs. Then, let’s examine the preparation of a flexible budget. Static budgets are often used by non-profit, educational, and government organizations since they have been granted a specific amount of money to be allocated for a period. That means, if efforts scale up to $15 million, then the variable portion of the costs of goods sold moves from $3 million to $4.5 million. Compare and contrast incremental budgeting, zero-based budgeting, and activity-based budgeting.

Creating a flexible budget

Which of the following reason cause flexible budgets to be useful planning tools? Flexible budgets allow managers to anticipate results under a variety of scenarios. Flexible budgets can help determine if a company’s cash position is adequate. Flexible budgets can help managers judge if materials and storage facilities are appropriate for various production levels. If such predictive planning is not possible, there will be a disparity between the static budget and actual results. In contrast, a flexible budget might base its marketing expenses on a percentage of overall sales for the period.

- In Excel, it is easy to build a forecast for the period by taking your expected revenue projections for the period and then applying the fixed and variable expense ratios you calculated.

- As such, the variable portion of the costs of goods sold is 30% of revenues.

- The static budget is prepared for a single level of activity, while a flexible budget is adjusted for different activity levels.

- Conversely, if revenue didn’t at least meet the targets set in the static budget, or if actual costs exceeded the pre-established limits, the result would lead to lower profits.

- They both play a part in good business accounting and are often used in personal finance, too.

- The break-even point is the level at which revenues _______.

The second budget is our flexible budget – using all of the same assumptions about sales price, cost of raw materials and cost of labour – but adjusted for the actual units sold. A static budget is a type of budget that incorporates anticipated values about inputs and outputs that are conceived before the period in question begins. A static budget–which is a forecast ofrevenueandexpensesover a specific period–remains unchanged even with increases or decreases in sales static and flexible budgets are similar in that: and production volumes. However, when compared to the actual results that are received after the fact, the numbers from static budgets can be quite different from the actual results. Static budgets are used by accountants, finance professionals, and the management teams of companies looking to gauge the financial performance of a company over time. The flexible budget responds to changes in activity and generally provides a better tool for performance evaluation.